Tokenization to Redefine Investing in Real Estate, But Regulators May Curb Market Growth

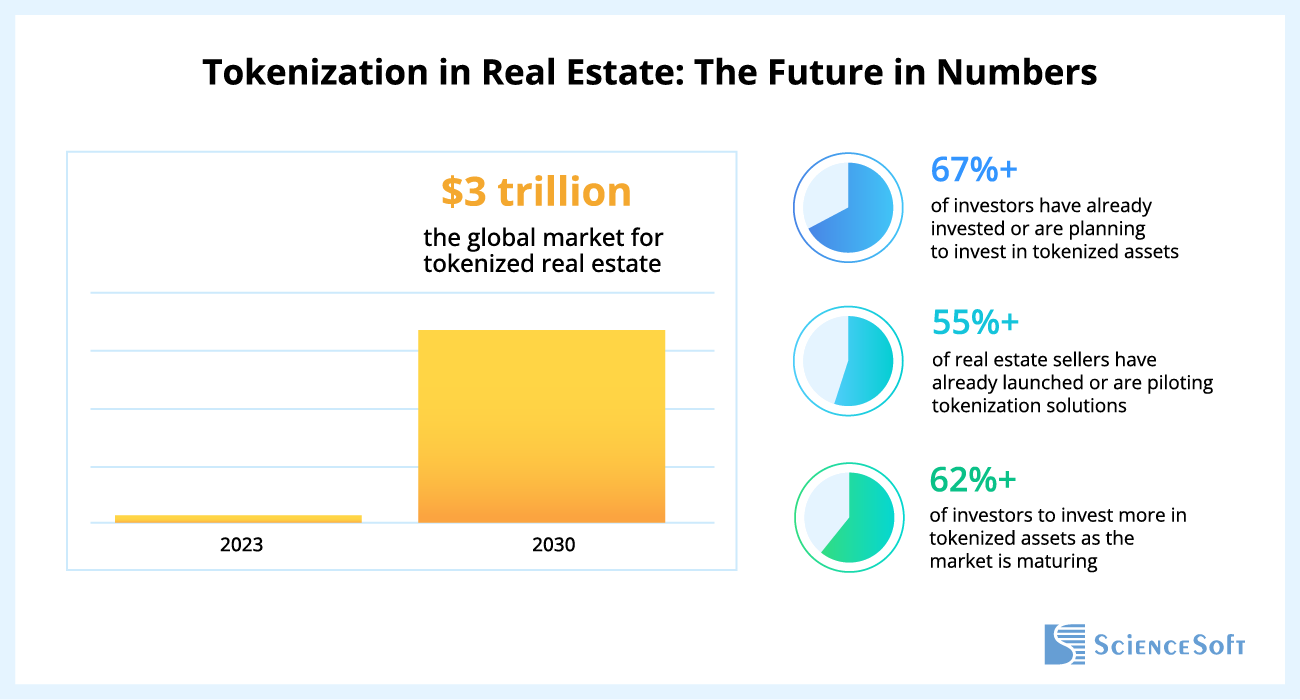

By 2030, the global market for tokenized real estate will reach up to $3 trillion and represent 15% of the real estate assets under management, ScienceSoft's research team predicts. Although the market is relatively young in 2025, real estate sellers are increasingly investing in tokenization technology, and investor demand is sufficient to justify the launch of token offerings.

Why Keep an Eye On Real Estate Tokenization

For 10 years, asset owners in the US have been ranking real estate as the best long-term investment. Still, high costs and low liquidity of real estate historically hindered investor demand. Costly settlement of real estate deals posed additional barriers to investing. It’s no surprise tokenization technology enabling partial asset sales and low-cost deal closing quickly gained traction among the real estate investment domain players.

Tradeable blockchain tokens can represent any required portion of the property, which enables fractional asset sales and shared ownership. Tokenizing real estate gives sellers an opportunity to boost asset liquidity and attract a broader pool of investors. Tokenization solutions automate real estate financial and title transactions, removing intermediaries and cutting down settlement costs for all deal participants.

As of 2025, the US market for tokenized real estate is proliferating and offers rewarding investment opportunities for real estate sellers, intermediaries, and tokenization technology providers. Some asset management companies have already invested in custom tokenization solutions and are planning to invest more in the next years. Early pilots by Elevated Returns and RealT proved the technical and economic feasibility of real estate tokenization. We expect that regulatory support and dedicated legal frameworks for tokenized estate trading will speed up further market growth.

Looking ahead, the growing use of tokenization in real estate will likely affect the demand for conventional REIT investments and mortgage loans and push investors to reconsider their portfolio structures. At the same time, enhanced asset liquidity will drive the volatility of the entire real estate market, potentially reducing its attractiveness for long-term investing.

Real estate tokenization isn’t just a trend. It’s a shift in how we think about ownership, access, and value. It’s where finance meets technology, and the future belongs to those ready to combine both.

Mary Zayats, Financial IT Principal Consultant at ScienceSoft (check the full video interview “Tokenizing Real Estate: Revolution or Hype?”)

Key Drivers and Hindrances of Real Estate Tokenization in 2025: Facts and Opinions

Demand for tokenized real estate

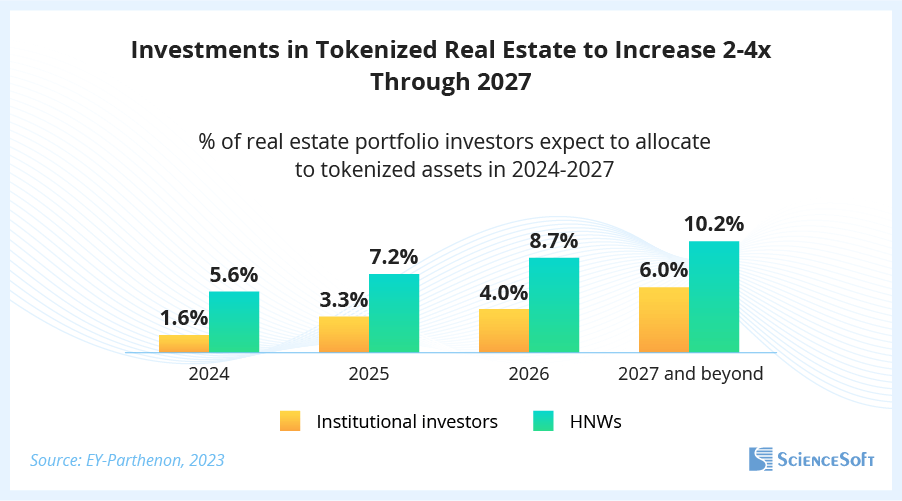

We found that investor demand justifies the launch of real estate token offering solutions. According to the survey by EY, as of May 2023, 80% of high net-worth (HNW) investors and 67% of institutional investors were already investing or planning to invest in tokenized assets. By 2026, institutional investors expect to allocate 5.6% and HNW individuals — 8.6% of their portfolio to tokenized assets. Both HNW investors (49%) and institutional investors (56%) cite real estate as their second most attractive tokenized asset investment option.

Regulatory impact on market growth

Roland Berger evaluated the market for tokenized real estate at $119 billion in 2023 and predicted that it would reach $3 trillion by 2030 at a CAGR of 60%. BCG projects that the market will grow from $120 billion in 2023 to $3.2 trillion in 2030 at a CAGR of 49%.

At the same time, analysts at KPMG and EY stress that the current US legal framework, where real estate tokens are considered securities and generic SEC restrictions are applied to investors, is a huge setback for market growth. Many of ScienceSoft’s clients from the investment sector believe that once regulators develop more flexible rules and allow lower-net-worth individuals to invest in tokenized real estate without constraints, we will see a surge in demand for this type of investment.

Tokenization technology maturity

Given ScienceSoft’s experience with tokenized asset projects, we knew for sure that blockchain tokenization technology is mature enough to develop solutions for a secure and cost-effective real estate token offering. Research by thought leaders mirrored our belief. For example, in its Hype Cycle for Web3 and Blockchain 2024, Gartner names tokenization an adolescent technology and predicts that it will reach mainstream adoption in 2–5 years.

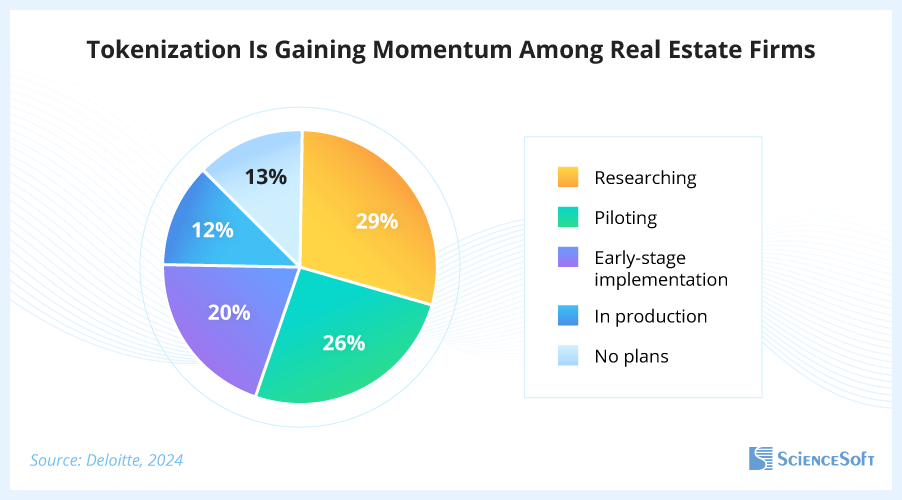

Although the market for tokenized real estate is relatively young in 2025, real estate sellers are increasingly investing in tokenization technology to enhance asset accessibility and reduce transactional costs. Deloitte found out that, as of June 2024, 12% of real estate firms globally had already implemented, and another 46% were piloting some asset tokenization solutions.

Tokenization software offering

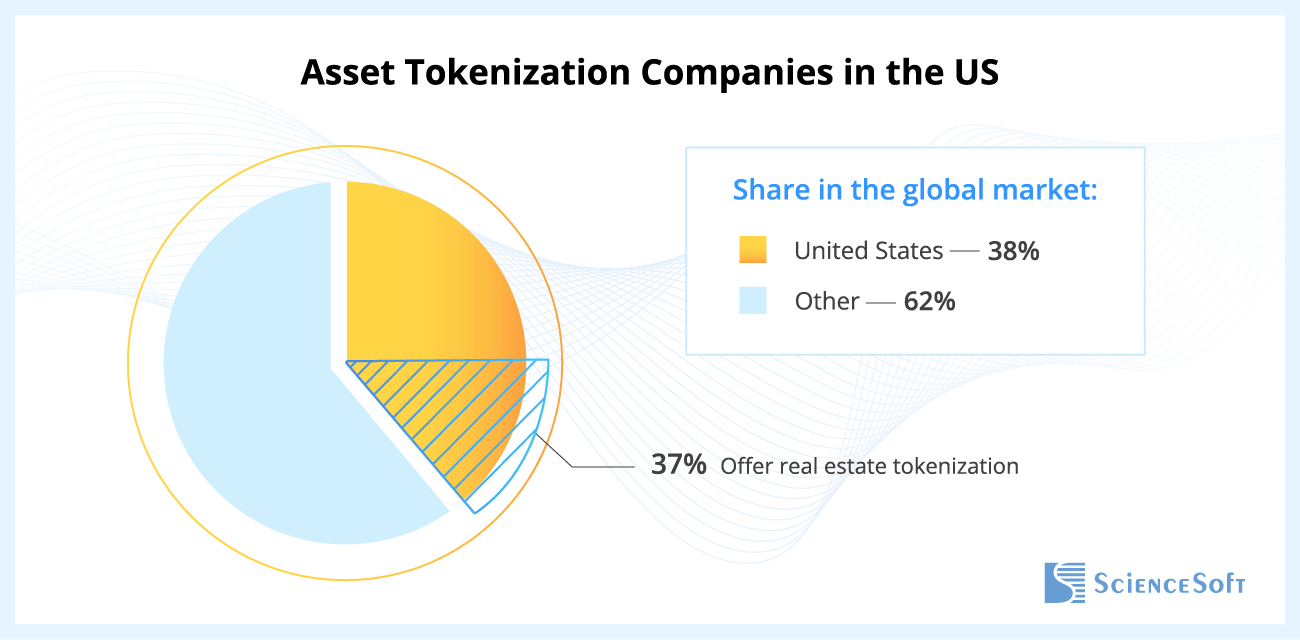

Next, we analyzed the market of real estate tokenization software, a critical factor defining how quickly real estate sellers can launch their token offering. Based on our findings, there are some service platforms for fast and cost-effective real estate tokenization, and the market is on the rise. According to Digital Asset Research, the number of tokenization platforms worldwide grew by 75% in 2023 alone. 38% of tokenization service companies were registered in the US, and 37% of them were working with real estate assets (e.g., SolidBlock, Tokeny, RealT, Polymath).

Yet, many larger real estate companies opt to build custom token offering software to support their complex ventures. ScienceSoft’s clients from the domain name reduced technology costs, tailored compliance, non-restricted tokenomics, and direct control over investor data as the major advantages of custom solutions.

Opportunities for secondary trading

One concern ScienceSoft’s investment clients commonly voice is the lack of interoperable secondary market platforms for real estate token trading. Indeed, as of 2025, tokens are still mainly traded within the platform of issuance, which limits investor reach and inhibits liquidity benefits. In its 2024 Tokenization guide, Deloitte mentions scarce secondary markets for tokens among the primary barriers to the mainstream use of tokenization.

The good news is that solutions for token interoperability between various blockchains and traditional financial systems are on the way. For example, Swift is collaborating with a Web3 services platform Chainlink and dozens of major financial institutions, including BNY Mellon, BNP Paribas, Citi, and Lloyds Banking Group, to test its solution for cross-network transfer of tokenized assets. Once launched, the solution will enable frictionless secondary trading of real estate tokens on multiple CeFi and DeFi marketplaces.

Industry players’ perspective

We interviewed business and IT leaders in the US real estate industry to find out if they believe 50%+ of real estate will be tokenized by 2030. The survey participants stress that real estate tokenization has a strong potential for development, but they believe that nowhere near half of real estate will be tokenized by 2030. Respondents note that residential properties, which make up the biggest share of the real estate market and usually assume full title ownership, do not have the same clear tokenization use cases as commercial estate. Thus, the residential sector will prevent tokenization from dominating the market in the mid-term. Some respondents also stressed that tokenizing residential real estate may violate the US mortgage regulations.

How Tokenization Reshapes Real Estate Investments

Real estate sellers (developers, owners, managers)

By fractionalizing and tokenizing their assets, real estate sellers will benefit from enhanced asset liquidity and the possibility of attracting a broader range of domestic and foreign investors, including individuals with smaller portfolios. As an alternative form of funding, token offering proved to help real estate owners quickly raise considerable capital volumes. For example, a New York-based asset management company Elevated Returns raised $18 million in investments within two years by tokenizing the equity of the St. Regis Aspen Colorado resort.

As demand for liquid assets is traditionally higher, tokenization may drive the growth in property value. In Elevated Returns’ case, the value of its token increased by 30% within 18 months of issuance. The token was listed on the secondary trading platform tZero and continued to trade strongly despite overall market uncertainty surrounding COVID-19. The token price gradually grew by an impressive 3.3x throughout 2022–2024.

Real estate tokenization comes with complete transparency and traceability of real estate trading transactions. Automating transactional tasks with the help of smart contracts will let real estate sellers optimize employee workload and cut operational costs in the long run.

While the sell side parties reap the biggest financial gains from real estate tokenization, they also bear the biggest upfront expenses. One needs to invest in property tokenomics and establishing dedicated security token offering solutions. The latter involves developing SEC-compliant smart contracts, building a custom or integrating an off-the-shelf solution for tokenized asset management, and partnering with tokenization and secondary trading platforms. From ScienceSoft’s experience, a real estate tokenization project of average complexity may cost around $200,000–$500,000.

Moreover, real estate sellers should be ready to take compliance risks. As the market evolves, sellers may face new legislation for tokenized real estate, which can compromise their legal posture and require additional expenses for adhering to regulatory requirements.

Author's note: Most of my clients in real estate investment cite regulatory uncertainty as the primary barrier to adopting tokenization. One way to de-risk tokenized offerings in a shifting legal landscape is to issue real estate tokens on compliance-native platforms like Securitize or SolidBlock. Major platform vendors are well aware of regulatory hurdles and typically offer built-in compliance features aligned with SEC and other relevant frameworks. And since they actively monitor legal developments, they can accommodate regulatory changes quicker and more effectively than most in-house teams.

Investors

Individual and institutional investors will benefit from wider opportunities for investing in real estate due to drastically reduced minimum investment. For example, a real estate token marketplace RealT, which tokenized 970+ properties in the US, sells tokens starting from just $50. 88% of platform users invested less than $5,000. Early adopters of RealT, Lofty, and similar say that the marketplaces operate and pay dividends as advertised.

As blockchain allows for seamless cross-border transactions with tokenized assets, investors will be able to access a broader range of properties worldwide and diversify their portfolios, bypassing currency and jurisdictional barriers. Automated direct settlement using smart contracts eliminates fees for intermediary services, reducing transactional costs.

At the same time, increased accessibility of real estate assets may lead to higher volatility and lower predictability of the real estate market, which means enhanced investment risks.

Real estate brokers and agents

Given that tokenization on blockchain enables real estate trading without intermediaries, its rising adoption may diminish the role of real estate brokerages and agencies and make some of their services obsolete over time. As buyers and sellers become more comfortable with peer-to-peer transactions, intermediaries should expect a decrease in demand and revenue.

To stay in the game, brokerages and agencies should grow new skills and adapt their business models to the evolving investor preferences. One winning strategy for intermediaries is to offer consulting services related to the creation and management of tokenized real estate. A step further would be to invest in a real estate token offering platform and enter the tokenization service market.

Technology providers

Since operations with real estate tokens rely heavily on blockchain and traditional technologies, technology vendors should expect increased demand for specialized solutions in the next 2–5 years. The growing popularity of tokenized real estate will indirectly benefit custom tokenization software vendors and the providers of tokenization platforms, secondary trade marketplaces, blockchain networks, and cryptocurrency wallets.