Behavior-Based Insurance To Reshape Life & Health Plans. Or Will It?

ScienceSoft, a US-based IT consulting firm with 13 years of experience in health insurance digital transformation, released a non-sponsored study exploring the potential of behavior-based insurance (BBI) in health plans.

By 2035, at least 60% of health payers will offer some form of behavior-based insurance (BBI) alongside traditional coverage types, ScienceSoft's research team predicts. The penetration of BBI in life and health products is low in 2025 but will rapidly grow (so be prepared).

The New Frontier for Health Insurance: Why Stay Abreast of BBI Trends

There is growing interest in the health insurance industry for specialized behavior-based insurance products, also known in the life and health domains as pay-as-you-live (PAYL) insurance. It’s no surprise PAYL is gaining traction: its potential operational and financial impact is transformative and propagates to all participants of the health insurance value chain.

BBI relies on insureds' dynamic health data (which can be gathered by apps and wearable devices, among other things) for ongoing risk assessment to reward healthy behaviors with lower premiums. The model allows for fairer, more controllable costs of coverage and comes with minimized risks for both payers and health-conscious customers. Meanwhile, healthcare providers can collaborate with insurers and use dynamic health data for preventive care. As BBI encourages healthy lifestyles, its growing adoption may lead to an overall improvement in the population’s health over time.

As of 2025, the US market for health BBI is projected to grow steadily and offers rewarding investment opportunities. Although we expect that it will take another decade for 60% of health payers to offer BBI, insurers can take a proactive approach to enter the niche early and maximize gains. The need for custom software engineering (there are currently no market-available BBI-enabling systems), as well as compliance and fraud implications, may hinder the adoption pace of BBI. Still, the solutions for safe and cost-effective model launch can be developed with the currently available technology.

Facts and Opinions Behind Our Prediction

Demand for PAYL products

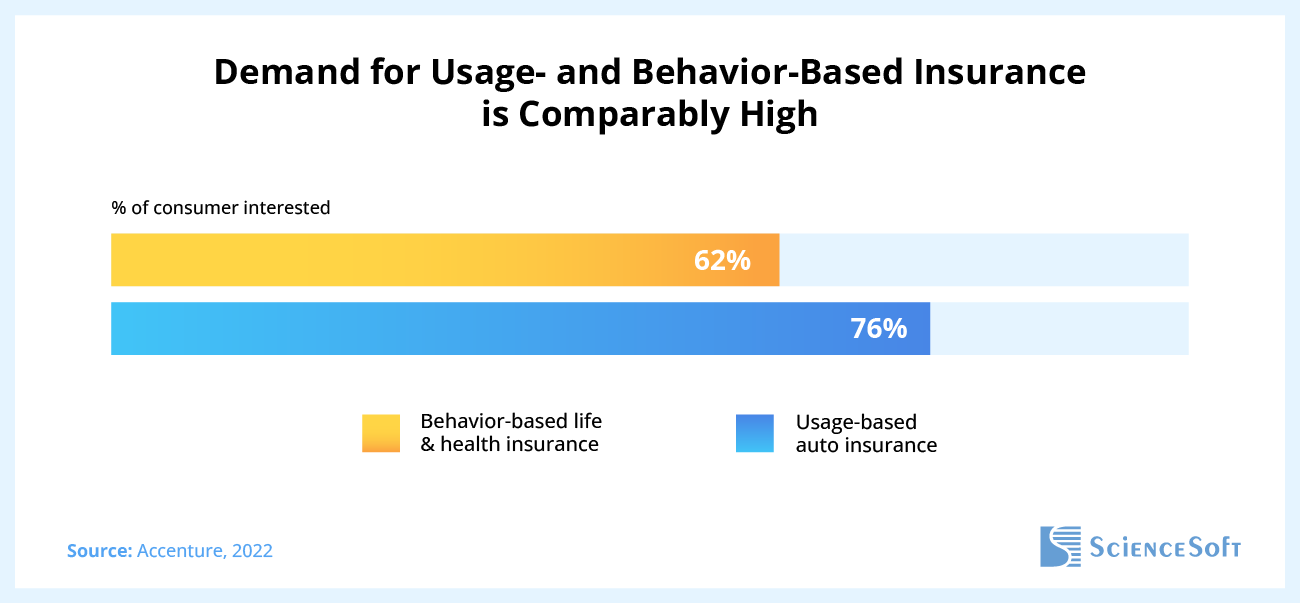

We found that customer demand is in place to justify the PAYL launch and economic feasibility. Growing premiums and complex buying journeys associated with traditional products push insureds to seek more affordable and personalized solutions. According to Capgemini, 75% of consumers prefer innovative life insurance options, with PAYL among the most popular alternatives to traditional policies. Accenture found out that demand for PAYL and UBI is comparably high (62% of consumers interested in life BBI vs. 76% – in motor UBI in 2022),

One of the demand hindrances we discussed with our client was the insureds' hesitation to share the necessary data. Surprisingly, it didn't appear to be a roadblock. For example, Accenture, in its 2023 and 2021 reports, highlights that 50–70% of US insurance customers are ready to share their health data with payers to secure premium discounts, access budget-friendly tailored offers, save time and effort, and receive professional advice on loss mitigation.

Seeking PAYL adoption patterns in motor UBI

To find patterns and make a prediction, we looked into a different insurance domain – motor insurance – where BBI originated and is today widely adopted. We expect that some of the historical usage-based insurance (UBI) trends in motor insurance will be mirrored in the PAYL field:

- 90% of the US motor insurance market leaders currently offer some form of UBI products. UBI accounts for 60% of total auto policies written.

- Around 26% of all US motor insurance customers hold UBI policies.

- BBI in motor insurance hasn't replaced traditional coverage options and is offered both as a standalone product and in combination with traditional policies.

- The growing adoption of UBI was largely fueled by advancements in technologies, such as AI-powered data analytics, IoT/telematics, and blockchain.

Technology maturation

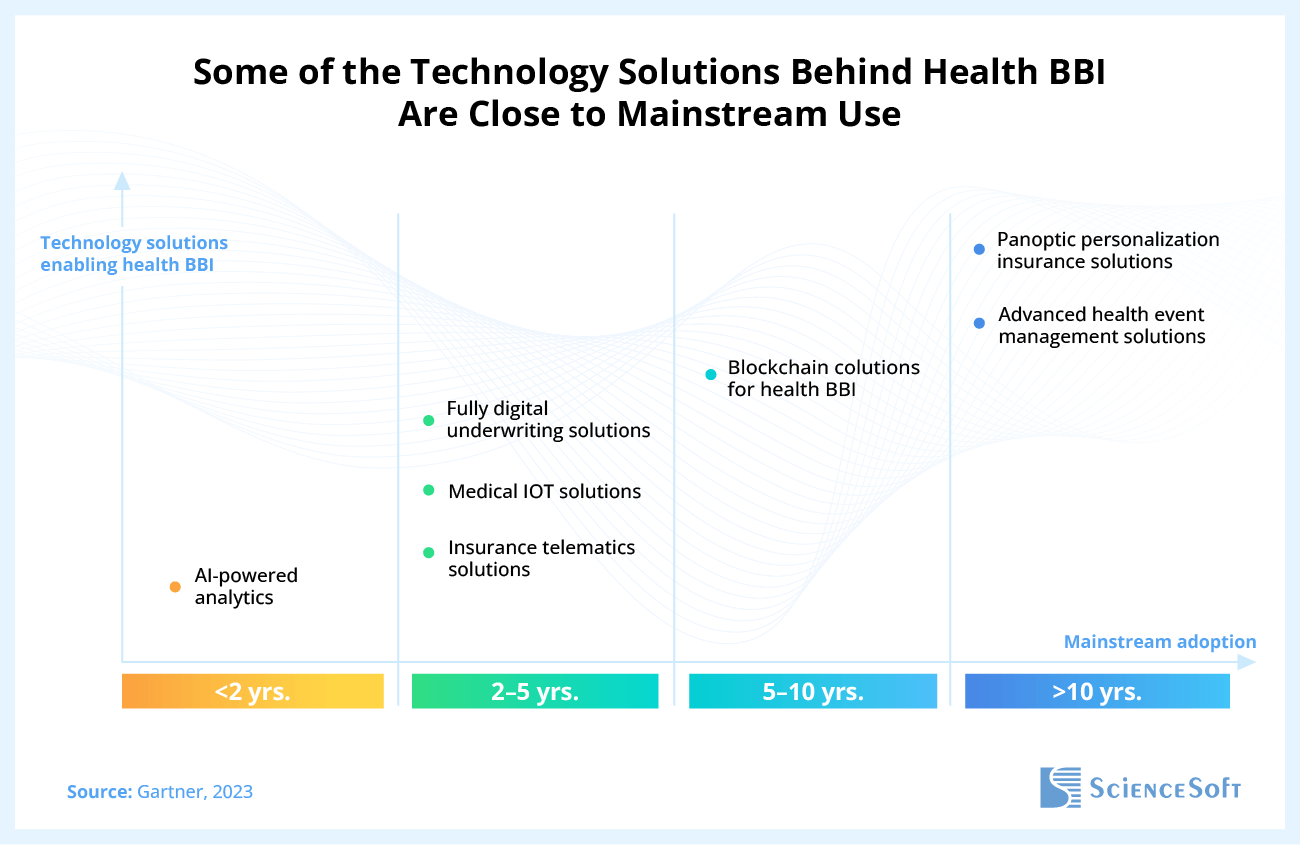

Next, we explored technological maturity, a critical driver shaping how swiftly PAYL insurance gains widespread adoption among payers. Our assumption was the technology's maturity level was low to medium, and research by thought leaders proved our point. For example, in its Hype Cycle for Digital Life and P&C Insurance 2023, Gartner says that the tech-driven panoptic personalization approach, a concept close to BBI in life and health, will reach mainstream adoption not earlier than in 10 years.

At the same time, some of the technology solutions enabling the PAYL model are more mature than others and are much closer to mainstream use in insurance. For example, AI-powered analytics are projected to be widely adopted within 2 years, and IoT and insurance telematics solutions – in 2–5 years. These should be a near-term priority for insurers seeking to proactively build up a technology basis for PAYL operations.

A perspective of industry players

Among the insurance business and IT leaders who took part in our survey, there's no unified opinion on the future of PAYL. Half of respondents believe that PAYL can become commonplace in life & health insurance by 2030, driven by consumers' increased demand for personalized products. Another half doubts that PAYL adoption will grow meaningfully in the decade ahead, naming data privacy issues, lengthy and complicated insurance software revamp, and insufficient consumer incentives to switch to BBI policies among the major market holdbacks.

What Influence Should You Expect

Insurance companies

The biggest benefits of the PAYL model go to insurers. Charging more for inept behaviors will let carriers dynamically respond to risks and reduce loss ratios, while incentivizing healthy behaviors will pay off via a cut in claim volume and an increase in health-conscious clientele.

The niche is warm but spare, and few competitors are on the horizon. For now, Discovery, a South Africa-based insurer, is the only large health BBI provider worldwide. Discovery's unique offer and well-designed franchise program gave the company a sure start: its Vitality products have attracted more than 35 million insureds globally.

PAYL's potential impact on the bottom line will vary depending on the business size. Taking John Hancock Life Insurance, the only US firm offering PAYL coverage, the revenue looks compelling even for a large payer: based on ScienceSoft's estimates, the PAYL program brought the company $312 million in 2023 alone.

The opportunities are exciting, but the efforts will only pay off for insurers who consider the potential downsides and are equipped to address them. First of all, launching PAYL will entail investments in modernizing existing IT systems and developing new BBI-specific solutions. Digital transformation may span 2–3+ years.

Insurers will also need to implement advanced fraud detection tools to recognize suspicious manipulations with wearable data. One respondent of our survey expressed a concern that users can potentially cheat the BBI model, for example, by sharing their wearables with more physically active friends. How to combat such fraud with technology, if anyhow, is an open question.

Moreover, insurers should be prepared to tackle potential social risks of PAYL products, such as misinterpreting and mispricing behaviors, unintendedly discriminating against low-income clientele, and fostering a tyranny of self-measurement. As a solution, researchers propose to factor in policyholders' social contexts and life conditions in addition to the health state. Such an approach, however, exacerbates data privacy concerns.

Insurance customers

PAYL insurance customers will benefit from lower premiums and greater control over their coverage spend. PAYL rewards look truly promising: Platinum members of the Vitality program, for example, saved 40% of their annual premiums, or a total of around $55 million, in 2023. In addition, the 2024 Vitality Impact Study indicates improvements in policyholders' physical activity levels, diet, and smoking habits.

Yet, it's unlikely that all consumers will reap equal financial benefits from PAYL products. Looking at the experience of BBI in motor insurance, many insureds are dissatisfied with their experiences, citing ambiguous behavior assessment processes, the pressure of constant surveillance, and the inability to achieve the intended premium discounts as the most frustrating aspects. For PAYL insurers, such feedback signals the need for transparent, non-intrusive controls and realistic incentives to introduce superior CX.

Technology vendors

Since the PAYL model relies heavily on advanced automation technology, technology vendors should expect increased demand for specialized PAYL solutions in the way ahead.

Author's note: The growing demand for health BBI tools means lucrative market opportunities for startups. But if you want to reap the early-comer benefits in the BBI tech space, don’t wait too long. Ideally, you should present your solutions on the market in 2025–2028 to reach BBI payers before the active planning stage. Established products foster more trust, so it’s already time to get the ball rolling.

As a startup, you might partner with a mature insurance software product company to swiftly access a large customer base in exchange for expanding your partner’s offer with innovative BBI tools. Partnerships between binah.ai and Sapiens and between Wellx and INSTANDA are examples of successful moves that have benefited both established players and newcomers to the niche.

Healthcare providers

Healthcare providers indirectly win from the growing adoption of PAYL. The industry can expand e-collaboration with insurers to use policyholders' dynamic health data for preventive care.