Boosting Customer Experience in Health Insurance: Can You Escape AI?

Editor's note: Olga Vinichuk, ScienceSoft's Insurance IT Consultant, shares tools and strategies for enhancing digital customer experience (CX) in health insurance, addressing insureds’ growing expectations, regulatory changes, and emerging security threats. The interview is led by Stacy Dubovik, a financial technology researcher.

PHI Security vs. Smooth CX: Can’t You Have Both?

SD (Stacy Dubovik): What, in your opinion, are the biggest hurdles to smooth digital customer experience in health insurance?

OV (Olga Vinichuk): Given that health insurers operate more sensitive data about their customers than any non-medical carriers, I see the sector’s primary challenge in bridging convenient digital CX with the robust protection of PHI. General CX improvement strategies like self-service automation, mobile support, and 24/7 assistance are great in theory, but they are bound to meet a wall of strict HIPAA requirements meant to prevent any data breaches across online interaction points. HIPAA-mandated security measures by their nature impede seamless CX. In my experience, data privacy and security concerns are by far the top hurdles for health insurers that want to expand digitally.

SD: So, how do we reduce friction in digital customer journeys without hampering PHI security?

OV: In consumer app projects, my colleagues usually apply single sign-on and adaptive multi-factor authentication. Such mechanisms proved to greatly simplify the login process for users with known contextual conditions (e.g., unchanged device or location). A simple step like maximizing re-authentication grace periods within HIPAA thresholds can free app users from the need to log back in repeatedly. Restricting user notifications to critical-only events like HIPAA-required password changes offers a non-intrusive way to keep health insurants updated on the necessary security actions.

Plus, the speed and performance of client-side apps are critical to seamless health insurance CX. Opting for optimized PHI encryption algorithms like AES-GCM would let health carriers establish faster in-app operations without sacrificing security.

From Boomers to Zoomers and Beyond: Boosting Convenience for Every Demographic

SD: Most health insurers use websites and mobile apps as their primary digital customer interaction channels. Will this stay the same in the next 10 years? Or must every insurer roll out other modern CX options to keep up with the times?

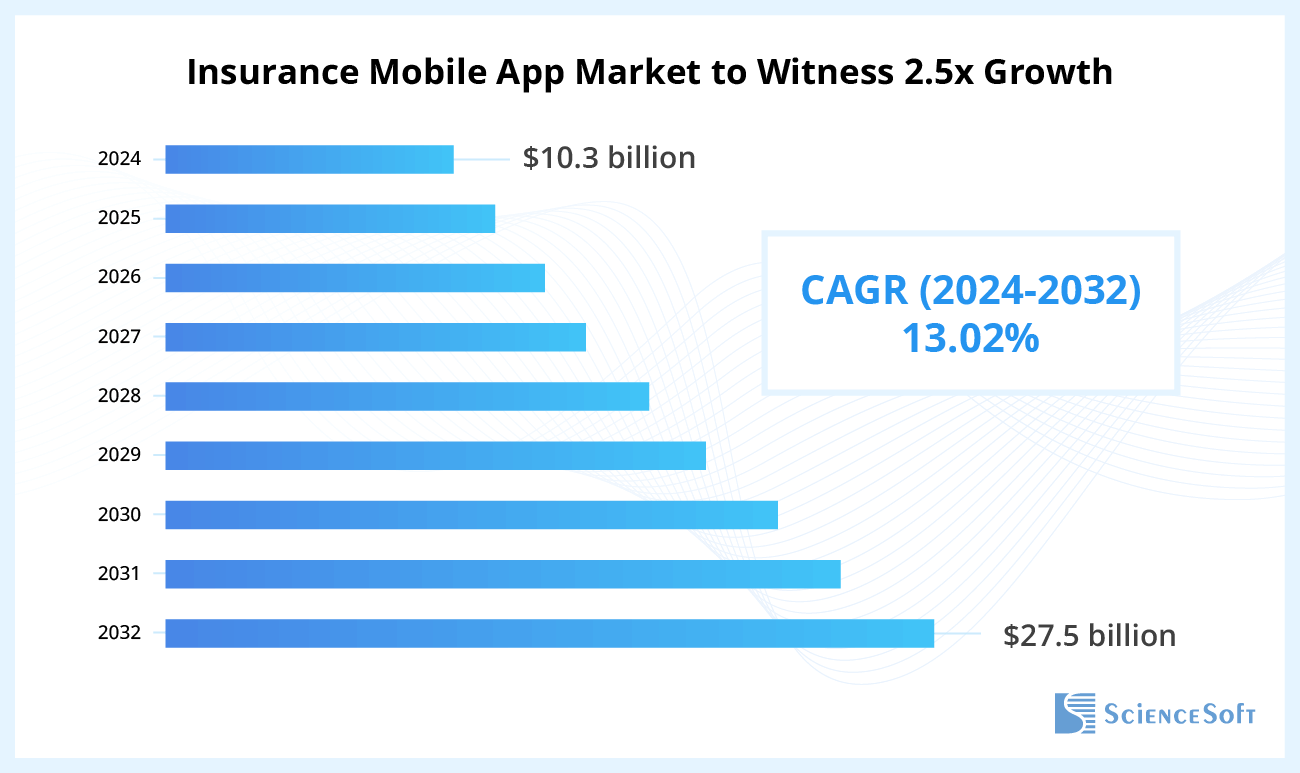

OV: A web portal is by far the pillar of digital health insurance interactions. Yet, I anticipate the share of mobile-only insured interactions to grow in the years ahead. Considering Gen Z’s mobile-first lifestyles, launching a self-service mobile app would be a wise step to win a younger audience. If you’re not ready to release a dedicated mobile app (or multiple), make sure your web portal has a responsive design and is easy to use on mobile devices. If you’re in emerging markets such as South Asia, however, many of your insureds likely have only mobile phones and no desktops, in which case releasing a mobile app is more important than updating any other digital channels.

SD: What other aspects should health carriers prioritize to drive high insurant satisfaction and engagement with self-service apps?

OV: As health insurance is designed for everyone, health payers by default deal with dispersed demographic groups. So I’d point out accessibility as the vital aspect of every successful health insurance app. In practice, it means that your web and mobile platforms must be compatible with versatile devices, localized for users with different lingual backgrounds, and easily operable by any demographic, be it Gen Z, the geriatric population, or insureds with disabilities.

Clear layouts, intuitive content, and straightforward user journeys would ensure smooth app navigation and minimize cognitive strain for every customer segment. Addressing the specific needs of users with disabilities requires creating dedicated accessibility features. For example, a high-contrast mode, font resizing, and screen readers will greatly benefit users with visual impairments. Internationally recognized guidelines like WCAG 2.1 delineate all the best practices for web and mobile accessibility and have several levels of conformance, from minimal to highest, which means you can start small if you don’t have the budget for advanced assistive features like voice commands.

App localization is no longer a costly and cumbersome task. Online localization services can be employed to auto-translate and culturally adapt the app’s content. Lokalise is one example of a workable choice for continuous software localization and translation management. This AI-powered tool supports 400+ languages and features pre-built SDKs and APIs for easy connection to custom apps. Using Lokalise, my colleagues have recently managed to complete banking app localization in 10 languages in just four months. Health insurers can repeat the success and elevate digital experiences for their ethnically diverse clientele quickly and with minimal upfront investments.

I also often advise my clients to introduce customer-side customization options to allow for a personalized touch and promote better app usability. Letting users change the app’s background image, reposition the widgets, or adjust notifications is a way for health insurers to avoid frustrating CX built on the one-size-fits-all approach and make customers feel in control of their experience.

Staying on Budget: Strategies to Introduce Novel CX to Dated Health Insurance Apps

SD: It sounds like it’s easier to build a cool and accessible app from scratch than to make a legacy portal meet all modern user expectations. Still, are there ways to make an old app more attractive to customers without total redevelopment? Not everyone is ready to invest in a completely new app for the sake of CX alone.

OV: From my experience, intelligent chatbots are one of the most rewarding investments for health insurance CX, and they can be deployed relatively easily even on dated websites. By providing immediate multi-language support and text-to-speech/speech-to-text options, AI-powered bots can accommodate users with different needs and abilities. Plus, more importantly, modern AI assistants can process over 90% of user inquiries about insurance products, claim filing, and operational issues right away. Additionally, as ScienceSoft’s practice shows, implementing smart chatbots on the customer side can bring up to a twofold reduction in agent workload, so the benefits go beyond CX alone.

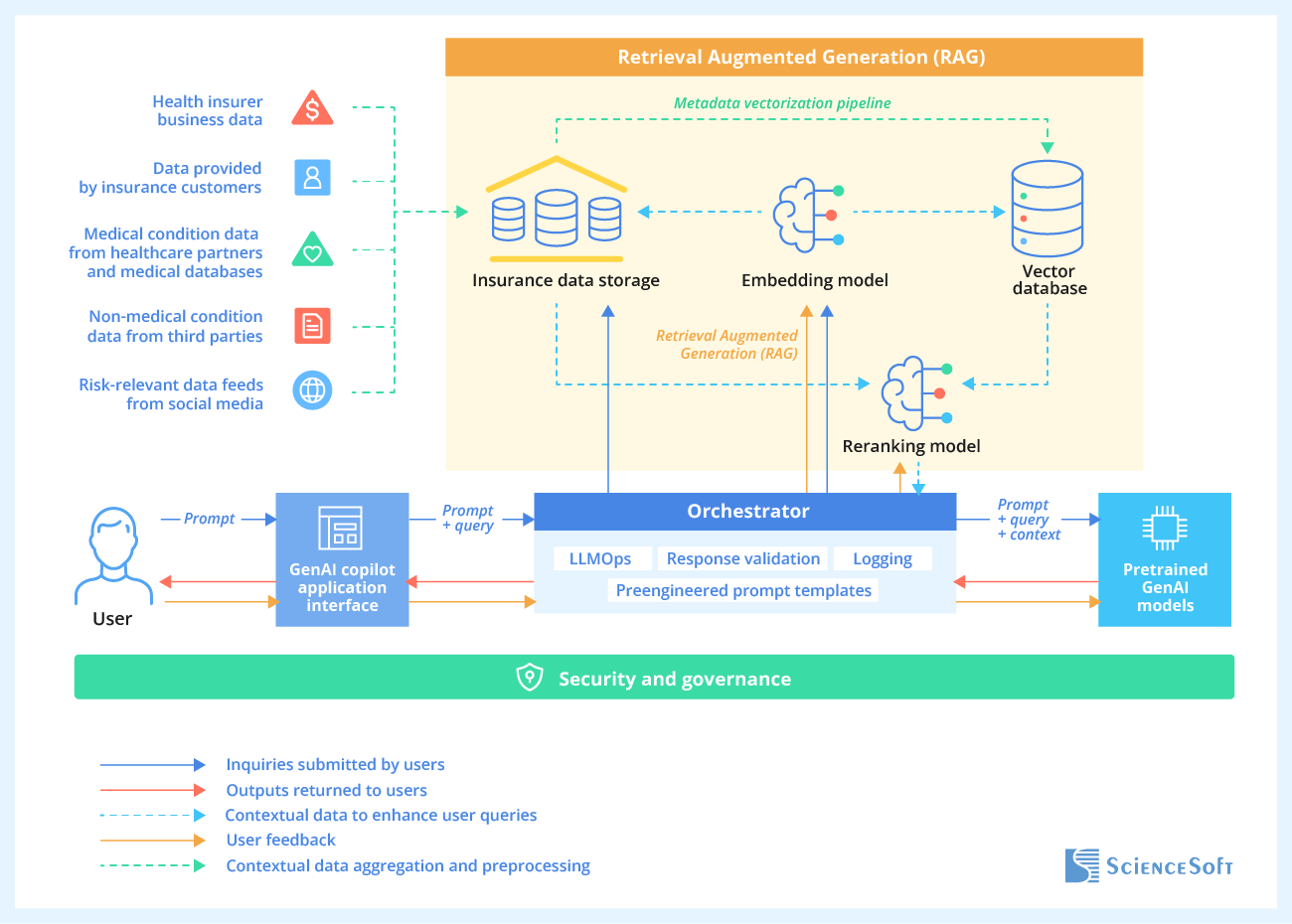

With cost-effective customization techniques like retrieval-augmented generation (RAG), constructing a custom ChatGPT-like assistant for health insurance clientele may be a matter of a few months and $250,000–$300,000 investments — it may still be a lot for some insurers, but as I mentioned, the ROI is going to scale up across the entire customer service cycle. Note that the bot’s underlying large language model (LLM) must be fully explainable, i.e., ensure transparent response logic. This simplifies the proof of adherence to operational compliance rules posed by FIO, NAIC, FTC, Medicare and Medicaid programs, etc. My colleagues from the data science team recommend interpretability techniques like LIME and SHAP to demystify LLM logic and reveal potential reasoning issues.

SD: Another common concern is low payback from new digital initiatives. From the technology perspective, what strategic steps should health insurers prioritize to make sure their CX projects pay off in the long run?

OV: When it comes to technology, reliance on aging software remains the main barrier to better digital CX. So, a reasonable strategy would be to first address the apparent technical debt and then bridge the remaining CX gaps with new solutions.

On the surface, steps like modernizing a customer app’s appearance and adding some trending features may seem sufficient to improve the insureds’ digital journeys. In reality, however, fragmented fixes do not bring impressive wins. Many client-side features are enabled via the integration with the insurer’s back-office systems where the actual data processing occurs. Self-service premium calculation and auto-issuance of standardized health coverage, for example, fully depend on the connected underwriting back end. If an insurer’s IT system rests on dated, low-performing tools, customer apps, however novel they are, will inherit the same speed and capacity issues. To secure a high payback, health payers should approach the revamp holistically and prioritize upgrading the systems where the performance has a critical impact on the quality of customer self-service.

SD: OK, but I imagine not many insurers are ready for a holistic revamp. What smaller initiatives can you suggest that would have the biggest impact on CX and boost confidence in further digital transformation?

OV: Customer data and behavior analytics play a crucial role in adequate customer segmentation, profiling, and digital CX planning. So, I’d point out robust customer analytics software as the first investment on the road to better CX for health insurers. As for the recommended tools, my colleague Zarina Babko shared multiple approaches and insurance CX analytics insights in her recent guide.

Automated customer data collection from external sources is another strategic CX direction that may require technical upgrading of an insurer’s back-office systems. Most health data providers offer go-to FHIR APIs for easy and secure access to medical information. If your legacy software is not compatible with ready APIs, you can avoid software overhaul costs by developing relatively cheap and simple middleware.

Notably, by obtaining insureds’ medical and socioeconomic data from third parties, health insurers can remove over 70% of customer routines associated with application filings. This is a strong driver for customer satisfaction: companies leveraging EMR integrations and automated data processing report 3x higher CSAT than the industry average.

Pragmatic Tool Stack for Customer Experience in Health Insurance — And Why You Can’t Escape AI

SD: Alright, let’s talk specifics. What tools or online services would you recommend to health insurers looking to improve their digital CX?

OV: Although the market of CX tools for insurance is seemingly dense, few ready-made products cover the specifics of health insurance and can be used outright. The Zipari suite is probably the only feasible choice for payers seeking quick and affordable CX solutions. The suite offers a go-to CX management platform, white-label portals, mobile apps, and chatbots designed exclusively for medical insurance. Zipari’s solutions may cost $10,000–$100,000+ annually, but the price is fair considering the minimized rollout and customization efforts.

If you pursue deeper CX transformation or want to compete on unique digital experiences, plug-and-play solutions are less ideal. In this case, you’d benefit from specialized software engineering and analytics platforms where you can construct client-side apps and manage segment-specific CX initiatives. Microsoft Cloud for Healthcare is the first to come to mind. Although targeting primary healthcare organizations, the service features a variety of pre-built data models, app components, workflow rules, APIs, and connectors specific to health insurance. Basically, what Microsoft offers is ready-to-use templates for client-side apps, virtual assistants, and analytics solutions based on its core platforms (Dynamics 365, Power Platform, Microsoft Fabric, etc.). Plus, Microsoft’s default hosting platform, Azure Cloud, offers ready guidelines and tools for achieving HIPAA/HITRUST compliance. From my experience, building digital CX solutions on Microsoft’s low-code platforms may cost up to 70% less than custom development.

Machine learning platforms like Azure Machine Learning, Amazon SageMaker, and Google’s Vertex AI help streamline and speed up the development of advanced analytical models – the ones used in behavioral analytics, automated communication, and fraud detection. For LLM solutions specifically, health insurers may use niche services like Amazon Bedrock or Azure OpenAI Service to quickly create their own chatbots based on GPT-4, LLaMA, Claude, and other market-leading models. Such services offer ready-made scripts for virtual private cloud and on-premises deployments, meaning you can roll out LLM assistants on your proprietary servers for extra security.

SD: What if a health insurer doesn’t want to rely on AI or can’t afford it yet? Can top-notch customer experience in health insurance be achieved with non-AI options only?

OV: It’s true that you can avoid AI for customer service and still use traditional means of digital interaction, but soon, you won’t be able to avoid AI in security. Recent advancements in AI-produced deepfakes caused a spike in digital identity forgery. AI fraud is not recognizable by any conventional security mechanisms, nor can it be easily captured by the human eye. Using smart fraud detection engines, or quite literally battling AI with AI, is, for now, the only viable method of spotting emerging threats and minimizing risks to customers’ sensitive information.

At the same time, despite the technology imperfections and compliance concerns, market players are enthusiastic about AI. 80% of insurers name AI among the top game-changers for their business, and 65% plan to invest $10M+ in cognitive automation by 2025.

However, the tech stack choices are largely individual and must be made in the context of each health insurer’s requirements and constraints. Companies seeking practical advice are welcome to turn to me or other consultants at ScienceSoft for assistance with their specific cases.