Artificial Intelligence (AI) in Debt Collection

Features, Architecture, Costs, Techs

ScienceSoft combines 36 years in artificial intelligence with 20 years of experience in lending software engineering to help lenders implement AI for data-driven planning and automated execution of debt collection tasks.

The Essence of AI for Debt Collection

AI in debt collection offers automated collections planning and execution, enabling 8x faster operations and bringing 2–4x growth in collector productivity. Intelligent automation of borrower interaction tasks helps reduce debtor coverage costs by up to 70% while ensuring an up to 10x increase in response rates. AI-supported optimization of debt recovery strategies drives a 25%+ cut in loan delinquencies and an up to 20% decrease in bad debt.

AI in Debt Collection: Market Overview

The global debt collection software market size was estimated at $4.8 billion in 2024. It's expected to reach $11.3 billion by 2033, exhibiting a CAGR of 8.89%. The increasing popularity of debt collection solutions powered by artificial intelligence is named among the key factors driving the market growth. AI-based software helps proactively identify at-risk repayments, design personalized collection strategies, and streamline omnichannel borrower outreach to maximize debt recovery rates and minimize loan write-offs.

How AI for Debt Collection Works

Main use cases

Collection planning

- Analytics-based identification of potential defaulters.

- Data-driven triaging of debts for collection.

- Suggestions on the most effective borrower segment-specific and personalized collection strategies and tactics.

Value: streamlined and more accurate collection planning, minimized risk of non-performing loans and associated losses, improved customer experience.

Collection execution

- Automated generation and distribution of tailored textual and voice payment reminders.

- Instant processing of omnichannel debtor responses and automated debtor communication.

- Monitoring debt collection compliance with internal and legal requirements.

Value: 90%+ manual collection efforts eliminated, reduced loan delinquencies, 100% compliant debt collection activities.

Collection optimization

- Monitoring response, delinquency, default, recovery, loss, roll rates and real-time analysis of debt collection efficiency.

- Intelligent recommendations on collection strategy improvements.

- On-the-fly adjustment of planned collection activities.

Value: improved planning of personalized collections, thus increased borrower response rate and higher probability of timely debt repayment.

AI solutions effectively automate both regular borrower follow-ups like payment reminders and complex debt recovery activities that involve regulatory reporting and restructuring poorly performing loans. Thus, on the one hand, AI-driven automation frees the lender’s loan servicing team from low-value routines, driving better productivity. On the other hand, it aids the team in efficiently handling complex debt cases, ensuring minimized defaults.

Architecture

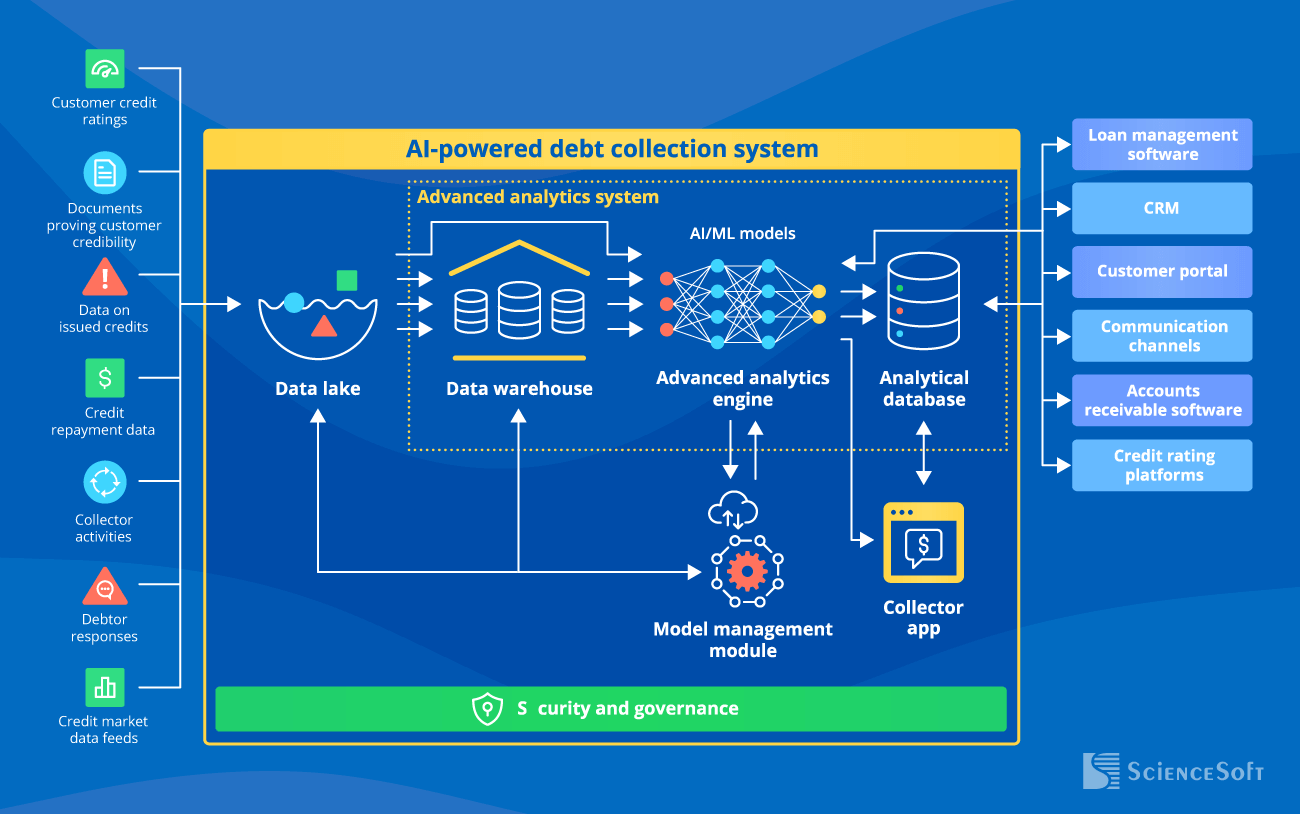

The architecture of an AI-supported solution for debt collection should enable secure data processing and be scalable to handle growing volumes of collection tasks. Below, we share a sample architecture of intelligent debt collection analytics systems we at ScienceSoft design:

- Collection-related data (borrower credit ratings, payments, collector activities, debtor responses, etc.) gets automatically captured from the available sources and routed to the data lake for storage.

- The data is instantly transferred to the analytics system for preprocessing (filtering, cleansing, enrichment). The ready-to-analyze data is then stored in a data warehouse.

- Data scientists use the data to train ML models. Non-neural-network (non-NN) models are suitable for moderate analytics complexity, while neural networks (NN), including advanced deep learning models, fit best for complex predictive and prescriptive tasks. Model engineering, training, and performance control occur in the model management module.

- An advanced analytics engine with a pre-trained AI model at its core analyzes the debt collection data, reveals dependencies between multi-dimensional variables, introduces predictions on the required metrics and events (borrower behavior, payment dates, delinquencies, defaults, etc.), and prescribes the optimal actions.

- Analytical results are routed to the analytical database for storage. They are instantly communicated to the debt collection team (via web and mobile collector apps) and integrated systems (e.g., a loan servicing system, a customer portal, CRM, accounts receivable software, mail, messaging, and dialing systems).

- NN-based debt collection models then continuously self-learn from the analytical outputs, while non-NN ML models require supervised or semi-supervised learning.

|

|

|

|

|

|

|

NB: Such an architecture can be flexibly extended with LLM-based agents to automate end-to-end lender workflows across delinquency risk assessment, collection planning and optimization, and personalized debtor interaction. |

|

|

|

|

|

|

|

|

Key features

Below, ScienceSoft’s consultants list the debt collection features that may be enabled with the help of AI, depending on the solution’s purpose:

Automated identification of debts to collect

An AI-supported analytics system monitors the up-to-date information about received and due payments, automatically identifies debts to collect, and notifies responsible collectors.

Default risk analytics

Red-flagging high-risk accounts based on the analysis of borrower credit history, delinquency, and borrower behavior data from all available sources, including social media, live visits, and telematics.

Debt collection prioritization

The prioritization is based on debtor risk and value, delinquency timeframe, amount due, and more. Debts can also be assigned to certain collectors based on priority and other factors.

Prescriptive analytics for debt collection planning

Recommendations on debt collection strategies and tactics (e.g., optimal interaction channels and frequency) for particular borrowers and borrower segments based on the analysis of borrower payment behaviors and collector-borrower interactions.

Collection message creation

Large language models (LLMs) can draft personalized textual reminders on due payments, tailored by different languages, lexis, tone, etc., based on the analysis of the debtor's location, age, occupation, communication history, and more.

Automated debtor outreach

AI-powered chatbots and IVR bots distribute personalized textual and voice payment reminders via email, messaging apps, SMS/MMS, a customer portal, VoIP system, and more.

Automated processing of debtor responses

AI-based optical character recognition (OCR), natural language processing (NLP), and image analysis technologies enable automated capturing and processing of multi-channel, multi-format debtor responses and promises to pay.

Debt collection adjustment

Suggestions (e.g., tweaking the tone of collection messages or changing the communication channel) are based on the ongoing analysis of debt repayment progress, borrower propensity and resistance to pay, and collection team performance.

Decision-making on debt recovery

AI-based prescriptive algorithms continuously monitor debtor behavior, spot the events indicating a debtor's inability or refusal to repay a loan, and advise on the necessity and the proper time for loan restructuring, delinquency reporting to credit bureaus, or initiating debt enforcement.

Automated compliance checks

AI-supported analytics systems verify collection activities against the internal policies and legal regulations (FDCPA, CFPB, TCPA, etc.). The areas of non-compliance are instantly reported to responsible parties to initiate timely actions.

Get Tailored AI Software for Debt Collection

Your solution can introduce complete automation of debt recovery activities and help effectively avert the risk of delinquencies and defaults.

Costs of Implementing AI for Debt Collection

From ScienceSoft's experience, developing a custom artificial intelligence solution for debt collection may cost around $100,000–$650,000, depending on the scope and complexity of the solution's capabilities, the number of AI models, and integration requirements.

~$150,000–$300,000

An AI-powered chatbot that automatically creates individual payment reminders and handles omnichannel borrower communication.

$250,000–$450,000

An AI-driven analytics system that predicts borrower behavior and automates debt collection planning and optimization.

$450,000–$650,000+

Complex AI-based software that enables real-time processing of debt collection data, prescribes the optimal collection strategy and tactics, and automates debt recovery tasks.

How AI Benefits Debt Collection in Lending

Turkish Bank with $65B+ in Assets Uses AI to Enhance Debt Collection Planning

Akbank, one of the largest banks in Turkey, partnered with a US lending startup Zest AI to build an AI-based solution for debt collection planning. Using thousands of data points – from borrower credit histories to Akbank's real-time collection metrics, the software precisely evaluates borrower repayment propensity and instantly predicts delinquencies across various loan types.

AI-based predictive analytics inform Akbank’s debt recovery planning, ensuring the proactive enforcement of adequate collection and loan restructuring procedures. With the help of AI, Akbank managed to survive a sharp rise in delinquencies caused by Turkey’s deepening recession with minimal financial losses.

Debt Collection AI Startup Raised $12M+ for 3 Years

A US-based fintech startup Attunely developed an innovative AI platform for the debt collection industry. The software relies on sophisticated ML models trained and tested on 4B+ of debtor interaction records and decades of collection history. It enables instant default risk assessment, provides accurate suggestions on debtor outreach strategies, and offers fully automated and compliant collection execution.

Attunely raised over $12 million in funding from 2018 to 2020. Today, the company partners with the leading US providers of next-generation debt collection software like CAS, Quantrax, and TCN to enhance the value of its AI solution further.

Factors Driving the ROI for AI in Debt Collection

Developing an AI-supported debt collection solution requires more than the right tech stack and architectural choices. Below, ScienceSoft’s AI consultants have outlined three important aspects to consider for successful AI implementation:

High accuracy of AI models

Training a high-accuracy AI model requires composing a comprehensive training dataset and adequately configuring model hyperparameters. This will eliminate the risk of debtor data misinterpretation and biased collection and debt enforcement prescriptions.

Built-in solution security

AI-based software must provide full security of debt collection data. Powering the solution with multi-factor authentication, role-based access control, data encryption, and intelligent fraud detection mechanisms will guarantee robust protection of sensitive collections info.

Regulatory compliance

AI-enabled debt collection flows must comply with the up-to-date standards and regulations like FDCPA, GDPR, and NYDFS. Formalizing compliance requirements in the automation rules and training AI models to consider these rules will ensure adherence to the relevant legal frameworks.

Debt Collection AI Consulting and Implementation by ScienceSoft

In AI implementation since 1989 and in lending software development since 2005, ScienceSoft delivers reliable AI-powered solutions for debt collection that help credit providers upgrade their unique collection workflows.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We deliver AI solutions for fast, accurate, and efficient debt collection processes. In our AI projects, we rely on robust quality management and security management systems backed up by ISO 9001 and ISO 27001 certifications. ScienceSoft's mission is driving project success by all feasible means, ensuring that the resource constraints are met and changes are addressed agilely.