Blockchain for Lending and Mortgage Loans

Capabilities, Challenges, Costs, Techs

ScienceSoft draws on 19 years of experience in lending software development and 5 years in blockchain implementation to deliver secure blockchain solutions for lending and mortgage loans.

Blockchain for Lending: The Essence

When used in lending, blockchain enables fully automated execution of loan agreements and brings a 15–60% decrease in operational costs. It offers transparent loan underwriting and ensures complete traceability of lending-related data. For mortgage lending specifically, blockchain helps eliminate manual efforts across the document-intensive mortgage close procedures and achieve a 50% shorter total transaction time throughout the mortgage cycle.

Blockchain for Loans and Mortgage Lending: Market Info

The global market of blockchain for banking and financial services was estimated at $4.61 billion in 2023. It is forecasted to reach $27.69 billion by 2028 at a CAGR of 40.4%.

With the expected growth of the BFSI blockchain market, the segment of blockchain-based lending is anticipated to show a corresponding increase. According to Fannie Mae, around 40% of lenders believe that decentralized finance offers a high potential to disrupt incumbent loan providers. The main driver for the rise of lending blockchain solutions is their ability to provide prompt and cost-effective processing of lending transactions and guarantee transparency and compliance of credit workflows.

How Blockchain for Lending Works

Architecture

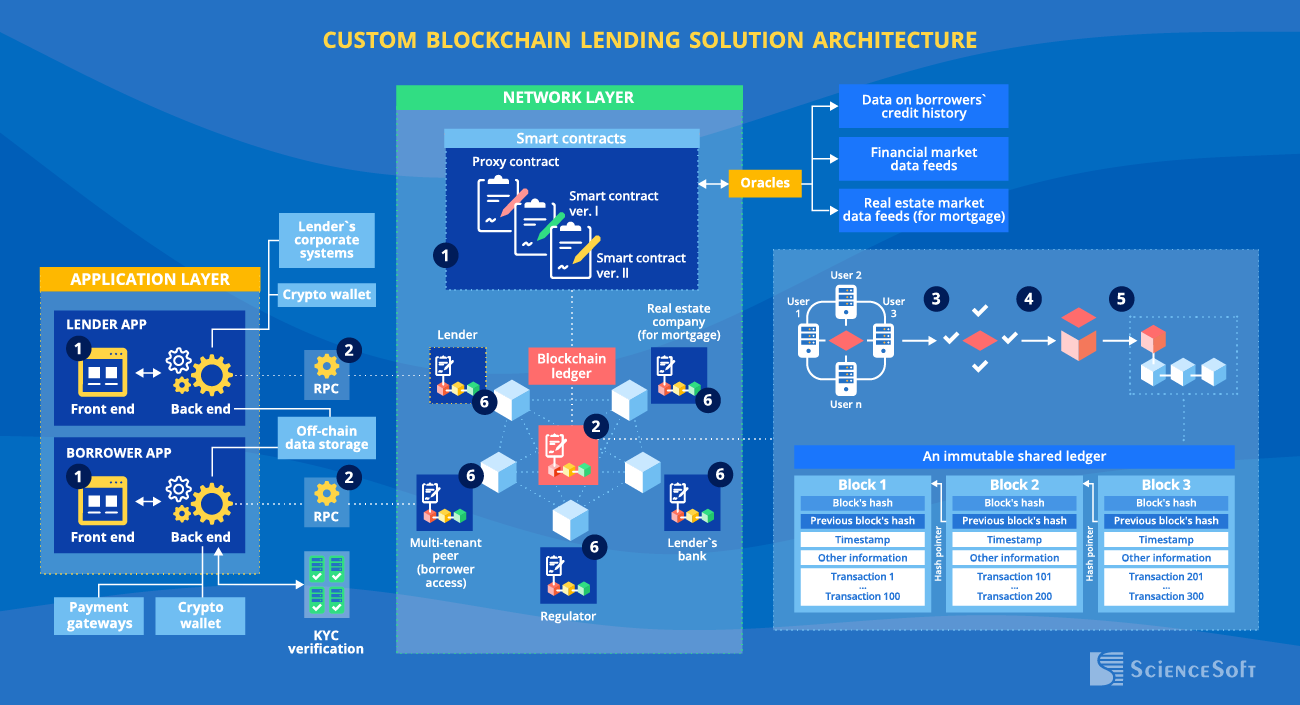

Below, ScienceSoft’s experts share a sample architecture of custom blockchain lending solutions we develop:

- A user (a loan officer or a borrower) submits the lending transaction via a role-specific web or mobile application. Particular transactions can also be enforced automatically by smart contracts upon the pre-defined events (e.g., funds transfer to the borrower upon signing the loan agreement). Smart contracts get the relevant lending data from off-chain sources (e.g., financial data marketplaces, credit bureaus) through blockchain oracles.

- The transaction is transmitted to the blockchain network (permissioned, permissionless, or hybrid). Lending metadata is transferred to the off-chain storage to avoid costly and power-consuming storage in the blockchain.

- The transaction gets validated by the authorized peers (validator nodes) according to the selected consensus protocol.

- The validated transaction is combined with other transactions to form a new block.

- Lending data gets encrypted with a hash function and stored in timestamped blocks. The blocks form an immutable blockchain ledger.

- All the network participants can view the new transaction in their own copies of the shared ledger.

Value-adding integrations for lending blockchain solutions

Lender’s corporate systems

(CRM, accounting software, a BI solution, etc.)

to securely share the data related to lending transactions or borrower behavior.

Main areas of application for blockchain in lending

Key features of blockchain-based lending software

ScienceSoft delivers custom blockchain-based solutions that enable robust automation of lending workflows and secure processing of borrower and credit data. Below, we share a sample feature set we would suggest for a comprehensive solution:

Automated data intake

Blockchain oracles instantly query external data sources and securely transmit the required lending-related data and documents to the blockchain network.

Automated KYC/AML verification

Blockchain enables automated borrower identity verification according to KYC/AML requirements and provides an immutable record of all borrower information updates.

Lending automation enabled by smart contracts

Smart contracts contain the rules for triggering particular lending transactions — e.g., generating a deed of trust upon receiving the mortgage down payment.

Consensus-based validation of lending transactions

Blockchain nodes validate multi-party lending transactions and prioritize them for processing and storage. Validation rules are defined by the chosen consensus protocol.

Transaction e-signing

Each blockchain participant has a unique crypto signature to e-sign the submitted lending transactions and prove their ownership.

Automated recordkeeping

Upon successful validation, lending data and transactions are automatically timestamped and recorded in the immutable blockchain ledger.

Lending data tracking and tracing

The distributed ledger enables blockchain participants to monitor all lending transactions in real time and trace their full history.

Full audit trail of credit documents

Blockchain keeps an immutable record of all manipulations across lending documents (loan applications, loan agreements, etc.): document creation, editing, viewing, sharing.

Loan repayment processing

Blockchain offers fast, 24/7 processing of domestic and cross-border credit repayments with no involvement of third parties. It supports payments in market-available and custom cryptocurrencies.

Security

Lending data security in blockchain is achieved via loan data hashing, multi-factor authentication, permission-based access control, and more.

How blockchain benefits major lending processes

Loan underwriting

- Real-time aggregation of loan applications and borrower documents due to the use of smart contracts and blockchain oracles.

- Prompt and precise automated quantification of borrower risks.

- Automated calculation of personalized loan prices according to a customer’s risk score.

- 100% accurate and transparent loan pricing due to the clear and openly accessible smart contract logic.

Mortgage close

- End-to-end automation of the mortgage close operations, from calculating mortgage-associated fees to generating title documents. This helps reduce the total transaction time throughout the mortgage cycle by up to 50%.

- A tamper-resistant record of the mortgage close data and documents.

- Automated loan prolongation, rescheduling, restructuring, and refactoring, which drives a 3–4x growth in the productivity of loan servicing teams.

- Full traceability of loan servicing transactions and events for the authorized parties.

Debt recovery

- Up to a 65% decrease in debt recovery costs due to automated debt collection and enforcement.

- An immutable record of debtor-collector interactions to facilitate control of collection-related activities.

Loan trading

- Streamlined loan trading on the secondary market due to automated generation, confirmation, and closing of loan purchasing and selling orders.

- 100% visibility of the loan trading activities and portfolio dynamics.

Lending payments

- Near-instant processing of domestic and cross-border payments from borrowers with no involvement of intermediaries.

- Automated enforcement of fund transfers to borrowers, third-party service providers, and legal entities.

- Advanced security of payment data due to asymmetric encryption.

- Fair loan pricing and high credibility between the members of the peer-to-peer lending pool due to transparent multi-party transactions.

- Automated workflows for loan origination, servicing, and renewal.

- Smooth and cost-effective processing of the blockchain-native crypto loans.

Fraud detection

- Automated detection of unauthorized and malicious lending transactions using smart contracts.

- A full log of fraudulent activities.

Regulatory compliance

- Smart-contract-based automation of compliance checks to guarantee data processing and loan reporting in accordance with the relevant legal standards.

How Lending Companies Benefit from Blockchain

Banking Giant Benefits from Faster and More Efficient Mortgage Processes

In 2016, Bank of China Hong Kong (BOCHK), a banking giant with $5B+ in operating profit, implemented a private blockchain for mortgage lending. The solution enables automated property valuation and loan approval in a secure, traceable, and incorruptible manner.

With the help of blockchain, BOCHK managed to reduce the property valuation time for mortgage deals from days to seconds. The solution made the mortgage origination process fully transparent for the bank, real estate companies, valuators, and mortgagees. Smart-contract-based automation is expected to bring a 15–60% reduction in operational costs.

The blockchain solution currently handles 85% of the bank’s mortgage-related property valuations. Impressed by the solution’s efficiency for mortgage, BOCHK also employed blockchain for its trade finance operations.

Blockchain Lending Startup Raised $7.9M in 3 Years

A US lending startup Teller Finance has developed a blockchain-based crypto loan marketplace for individuals and SMBs.

The platform supports unsecured personal loans, collateralized commercial and mortgage loans, and BNPL loans for NFT buying. It enables fully automated loan origination and servicing and provides 100% transparent loan history in the immutable shared ledger. KYC verification and credit checks are not mandatory. However, users can connect their bank accounts to the marketplace to prove their creditworthiness to potential lenders and qualify for lower interest rates.

Teller Finance raised $7.9 million in funding from 2020 to 2023. Today, the company operates globally and partners with a range of established crypto players, including Coinbase and WalletConnect, to deliver additional value with its product.

Technologies We Use for Blockchain Implementation

Overcoming Blockchain Data Accuracy and Security Challenges

Challenge #1: Low quality of lending data

Once recorded in the blockchain, loan-related data becomes immutable and informs further transactions. For example, data on borrower credit score impacts the loan limit, and currency exchange rates affect the recorded due amounts for multi-currency loans. It’s crucial to ensure high data accuracy to prevent costly financial errors.

Solution

Challenge #2: Blockchain vulnerability to cyber threats

Although blockchain solutions provide advanced security for on-chain lending data, they can be susceptible to external cyber threats, such as code exploitation, routing attacks, and phishing.

Solution

Costs of Blockchain-Based Loan Processing Software

In ScienceSoft’s experience, the primary factors that affect the cost and duration of loan blockchain development include:

- The scope of lending workflows supported by blockchain (underwriting, loan servicing, payments, etc.).

- The number and complexity of smart contracts needed for lending automation.

- Performance, scalability, security, and cross-chain interoperability requirements.

- The scope and complexity of integrations.

- Role-specific requirements for the UX and UI of lending apps.

- (For blockchain solutions built from scratch) Blockchain network type and the selected consensus algorithm.

- (For platform-based blockchain software) The chosen blockchain platform.

- The required development scope (PoC, MVP, full-featured software).

- The chosen sourcing model and team composition.

Developing a customer-facing lending app that relies on an existing blockchain network may cost around $150,000–$250,000. A fully featured blockchain solution with role-specific apps and a custom blockchain network for loan processing will cost $500,000–$1,500,000+.

Want to know the cost of your blockchain-based lending solution?

Build Reliable Blockchain Lending Software with ScienceSoft

In lending software development since 2005, ScienceSoft creates effective and secure blockchain solutions for credit and mortgage loans.

What makes ScienceSoft different

We deliver high-quality financial solutions no matter what

ScienceSoft delivers financial IT solutions that outperform competitors in logic accuracy, no matter the challenges posed by evolving customer expectations, changing regulations, or legacy system constraints.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We deliver robust blockchain solutions for fast, secure, and compliant loan processing. In our blockchain projects, we rely on mature quality management and security management systems backed by ISO 9001 and ISO 27001 certifications. ScienceSoft's teams drive project success no matter what, ensuring that the resource constraints are met and changes are addressed agilely.