Money Lending App Development

Steps, Techs, Costs, High-Value App Features

ScienceSoft combines 25 years of expertise in web and 19 years – in mobile development with 19-year practice in creating financial solutions to introduce robust money lending applications.

Money Lending Application Development: Summary

Money lending app development helps lending companies provide their customers with a secure, fast, and convenient way to access the needed funds and repay the loan.

Custom lending apps support all required loan types, languages, currencies, and payment methods. They offer a unique visual style, seamlessly integrate with the required systems, and can be easily upgraded with new features.

How to create a money lending app in 7 steps

- Research the market, TA needs, and case-relevant regulations.

- Design the app focusing on accuracy, scalability, and security.

- Select a pragmatic tech stack for app development.

- Plan project deliverables, tasks, schedule, budget, and risk mitigation steps.

- Develop the app and perform its rigorous testing.

- Integrate the app with the necessary systems and tools.

- Establish resilient and secure infrastructure and set the app live.

Timelines: 6–11 months on average.

Cost: $120,000–$400,000+, depending on solution complexity. For a more accurate estimate customized to your specific needs, try using our online cost calculator.

Team: a project manager, a business analyst, a solution architect, a UX/UI designer, a DevOps engineer, a front-end developer, a back-end developer, a QA engineer.

Having 750+ experienced IT talents on board, ScienceSoft offers various cooperation models and can quickly provide all necessary competencies to cover the end-to-end development of your lending application.

Why it's high time to build a custom lending app?

Rapid advancements in lending technology, evolving consumer preferences, and the proliferation of smartphones are changing the way lenders grant and serve loans, spurring the adoption of digital lending models. The digital lending market was estimated at $453.32 billion in 2024 and is expected to reach $795.34 billion by 2029 at a CAGR of 11.9%. The growing popularity of e-lending drives lenders’ demand for branded client-side apps and gives fintech startups an opportunity to tap into the dynamic market with a new solution.

Types of Money Lending Applications

There are various kinds of loan apps that differ in a tech stack, target users, supported credit types, and more. Below, ScienceSoft’s consultants share some examples of custom apps commonly requested by our clients from the lending domain:

By app platform

- Mobile lending apps.

- Web lending apps.

By target borrowers

- Consumer lending apps.

- Commercial lending apps.

By loan type

- Apps for personal loans.

- Apps for small business loans.

- Apps for mortgage loans.

- Apps for auto loans.

- Apps for student loans.

Innovative app types

- Microlending apps.

- Buy Now Pay Later apps.

- Peer-to-peer lending apps.

- Crypto lending apps.

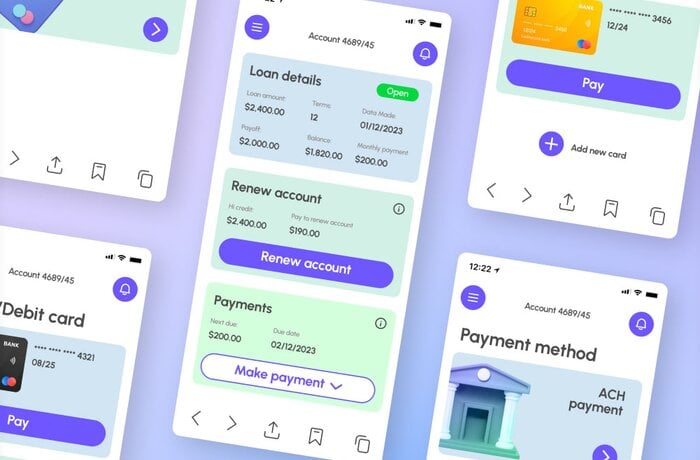

Key Features of Web and Mobile Loan Apps

In ScienceSoft’s projects, our team creates money lending solutions with unique functionality tailored to the specific needs of each client. Below, we list the features that form the core of a robust loan app:

Account management

Borrowers can self-register an account via a region-specific form and add the necessary account information, such as personal/business data, billing details, tax IDs, default payment method (bank account, credit card, digital wallet, etc.), and more.

KYC/AML verification

Borrower data gets automatically matched against the lender’s pre-qualification requirements (e.g., location, minimal monthly income, minimal age for individual customers, etc.) and region-specific AML/CFT and OFAC compliance requirements.

Loan calculator

By setting up criteria like a loan purpose, the desired term, and the amount needed, borrowers can find the fitting loan offers and calculate APR and the total credit cost for their particular cases. The app offers a side-by-side comparison of loan options.

Loan application

Borrowers can create loan applications from templates and instantly submit them to the lender. Intelligent image analysis and machine learning are employed to instantly process borrower documents (identity, solvency, collateral, etc.) and auto-populate application forms with the relevant data.

Loan repayment

The app can be designed to support multiple payment methods and payment currencies, including crypto. Each borrower can configure automated recurring payments based on its loan repayment schedule. Payments are processed in real time via the connected payment gateways.

Loan progress control

Customizable dashboards enable borrowers to track active and past loans, application processing progress (sent, approved, funded, etc.), paid and due invoices, and more. The app notifies users about updates of loan statuses, due payment dates, identity documents nearing expiration, etc.

Intelligent virtual assistants

AI-powered chatbots help borrowers navigate the app and solve operational issues. They can be trained to advise borrowers on the best-fitting loan products and guide debtors through loan restructuring. In-app messaging lets borrowers reach out to human reps directly in case of complex issues.

Security and compliance

The app can be secured via multi-factor authentication (including biometric authentication), data encryption, intelligent user behavior analytics, RASP, and more. Custom solutions can also enable compliance with GLBA, EFTA, PCI DSS, GDPR, NYDFS, CCPA, and other global and regional standards.

Interface customization

When a borrower first opens the app, the app requests the user’s location, defines the location-relevant language, and auto-translates the interface contents. Self-personalization features let users configure the app’s color scheme, loan dashboards, notification widgets, and account time zone.

A Roadmap to Money Lending Application Development

Below, ScienceSoft describes the main steps to take to introduce a competitive lending application and shares advice on improving the app's value and optimizing development project costs.

1.

Market and target audience analysis

Our consultants thoroughly explore the important aspects that define functional and non-functional requirements for the app and lay the basis for creating a unique selling proposition. Particularly, we analyze:

- The client’s business specifics and the lending app vision.

- The app’s target audience, its pains, needs, and behavioral patterns.

- Key market players, their weaknesses and strengths.

- Recent market trends: popular business models, innovative technologies, UX and UI perks, etc.

- Global and local compliance requirements for the target markets where the client is planning to operate, e.g., KYC/AML requirements, PCI DSS standards, CCPA regulations for the US, GDPR for the EU.

2.

Application conceptualization and design

- Defining the type of a money lending app (web, mobile, or both).

- (for a lending mobile app) Deciding on the approach to app development – native or cross-platform.

- Suggesting an optimal feature set for the application, including value-adding functions powered with advanced techs (e.g., AI, OCR, big data, blockchain).

- Prioritizing features based on their importance for the target audience and potential to drive a fast payback.

- Designing accurate and compliant logic for automated money lending operations.

- Designing the scalable and sustainable architecture of the application.

- UX and UI design for the required user roles (borrowers, lenders, app admins, etc.), which covers UX research and prototyping, usability testing, and creating UI mockups.

- Introducing a plan of integrations with the required internal and third-party systems (e.g., loan processing software, accounting software, payment gateways, credit rating platforms, financial data marketplaces, etc.).

Tastes differ. And ScienceSoft always cares to deliver convenient UX and sleek UI to make borrower and lender journeys engaging and seamless. This is why our apps stand out among other market-available solutions, build customer trust, and drive a high retention rate.

3.

Tech stack selection

We compare possible techs and tools in the context of the client's priorities (e.g., fast development, minimized project cost, etc.) and define an optimal tech stack with the client’s goals in mind.

To optimize project duration and costs, we rely on proven development frameworks, cross-platform mobile techs, and employ ready-to-use components (building blocks for the app logic, open-source APIs, OOTB UI components, prebuilt deployment scripts, etc.), if applicable.

4.

Project planning

An accurate, all-encompassing plan for app development helps significantly reduce project timelines and prevent operational and financial risks. A typical project plan by ScienceSoft comprises:

- Objectives, KPIs, and milestones for the project.

- Project deliverables, duration, and budget.

- Team composition and collaboration workflows.

- A strategy and a plan to mitigate possible project risks.

- TCO and ROI estimations for the lending app.

5.

Money lending app development and testing

The development of a lending application with ScienceSoft usually includes the following stages:

- Establishing automation environment: configuring CI/CD pipelines, setting up container orchestration tools, introducing test automation, etc.

- Coding the app’s back end and developing APIs to integrate the app with the required systems.

- Creating role-specific user interfaces.

- Quality assurance of each app component in parallel with development.

- Eliminating possible vulnerabilities and logic errors and fixing the identified code defects.

Developing and launching an MVP allows for a quick and cost-effective assessment of the solution’s viability and a faster payback from the app implementation. An MVP also helps avoid excessive investments associated with the app modification, which may potentially be required upon receiving the initial feedback from the app users. We can deliver an MVP of a custom lending app in 3–5 months and consistently grow it to the fully-featured solution with major releases every 2–3 weeks.

6.

Application deployment and integration

ScienceSoft configures the lending app’s infrastructure, backup and recovery procedures and deploys the solution in the production environment. After that, we integrate the app with the client’s corporate systems and relevant third-party tools and perform integration testing to guarantee proper functioning of the integrated solution.

ScienceSoft can also assist in designing a landing page for app promotion or uploading the money lending app to the required web or mobile app stores to streamline the app release.

As a part of our deployment service, ScienceSoft’s team establishes compliance procedures to meet the required standards and regulations. We also implement robust infrastructure security tools (authorization controls for APIs, DDoS protection algorithms, firewalls, IDSs / IPSs, etc.) to protect your application from cyberattacks.

7.

Support and evolution (optional)

ScienceSoft offers continuous monitoring and optimization of the money lending app to ensure its stable performance, top-flight security, scalability to serve a growing number of users, and ability to provide smooth user experience. We can create and release new functionality according to a lending company’s or end users’ evolving needs.

Consider Professional Services by ScienceSoft

ScienceSoft applies 19 years of experience in creating custom lending software to provide lending companies and fintech startups with:

Why develop a money lending app with ScienceSoft

- Since 1999 in web development and since 2005 in mobile development.

- Since 2005 in building solutions for banking and financial services.

- Since 2003 in cybersecurity to ensure world-class protection of lending applications.

- In-house compliance experts to guarantee lending app compliance with relevant global and country-specific regulations.

- Quick project start (1–2 weeks) and frequent releases (every 2–3 weeks).

- Well-established Lean, Agile, and DevOps cultures.

What makes ScienceSoft different

We deliver high-quality financial solutions no matter what

ScienceSoft delivers financial IT solutions that outperform competitors in logic accuracy, no matter the challenges posed by evolving customer expectations, changing regulations, or legacy system constraints.

How to Build a Loan App: Featured Success Stories by ScienceSoft

10 results for:

Mobile-Friendly Lending Portal to Boost Borrower Satisfaction and Employee Efficiency

In 6 months, ScienceSoft developed a ready-to-use portal that offers secure borrower features and integrates with the Customer’s LMS. Due to the portal’s efficient design and tech stack, the Customer managed to reduce the development and maintenance costs.

Mobile Credit Platform Revamp and AWS Cost Optimization in 3 Months

ScienceSoft migrated a mobile credit platform to the new AWS region, resolved the bugs in a loan app’s code, and implemented new lending features. The Client capitalized on lower cloud infrastructure expenses and faster time-to-market for its product.

Cross-Platform App for Convenient Access to Online Credit Marketplace

A sleek app built on Ionic and Cordova offers intuitive mobile lending experiences for iOS and Android users and streamlines collaboration between borrowers and credit intermediaries. Thanks to ScienceSoft’s Agile processes, the Client got the app launched in just 3 months.

Typical Roles on ScienceSoft’s Lending App Development Teams

Project manager

Plans the project (deliverables, schedule, budget), coordinates the team, monitors the project progress, and reports it to the client.

Business analyst

Analyzes needs and expectations of a client’s target audience and translates them into functional and non-functional requirements for the lending application.

Solution architect

Architects the app and plans integration points for its components and required systems.

UX/UI designer

Designs the user experience and role-specific user interfaces of a lending app, conducts usability testing.

DevOps engineer

Configures the DevOps automation environment for facilitated app development, integration, testing, and release.

Front-end developer

Delivers UI of a lending app and fixes defects found by the QA team.

Back-end developer

Delivers the server-side code of a lending app, integrates the solution with relevant systems, and fixes defects found by the QA team.

Quality assurance engineer

Creates and implements a test strategy, a test plan, and test cases to validate the quality of a lending app, reports testing results.

NB! Depending on the project specifics, ScienceSoft can involve additional talents, for example, blockchain developers to build a crypto lending app.

Sourcing Models for Money Lending Application Development

ScienceSoft’s Tech Stack for Loan App Development

In lending app development projects, ScienceSoft’s team usually relies on the following tools and technologies:

Solutions that Integrate with a Money Lending App

To enable seamless loan origination and funds movement between the involved parties, a money lending app needs to integrate with a loan processing system of a lending company. Visit ScienceSoft's dedicated pages to learn about the capabilities and specifics of loan processing solutions a customer-facing loan app may connect to:

An all-in-one solution used by banks, credit unions, and independent lending service providers to manage a full scope of lending activities.

Software that automates the processing of mortgages and facilitates interactions between the parties involved in a mortgage deal.

A solution aimed to directly connect private lenders and borrowers without the involvement of financial institutions.

A blockchain-based market platform that enables seamless origination and servicing of cryptocurrency loans.

Costs of Lending Application Development

Cost factors

Development cost factors

- The type of a lending app – web or mobile.

- (for mobile apps) Supported mobile platforms (iOS, Android, cross-platform).

- The scope and complexity of the app’s functionality.

- The number and complexity of integrations.

- The number of user roles, UX and UI requirements for each role.

- Performance, scalability, availability, security requirements.

- The chosen sourcing model and team composition.

Operational cost factors

- Fees for the required cloud services, ready-made app components (e.g., credit rating services, KYC/AML verification services, messaging services), integration APIs (banking APIs, financial market data APIs), and security tools.

- Maintenance of compliance with the required regulations, including periodical compliance audits.

- Lending application support services.

Ballpark estimates

From ScienceSoft’s experience, building a mobile lending app of average complexity costs around $120,000–$180,000, while developing a comprehensive web-based money lending solution may require $400,000+ in investments.

Wondering how much your lending app will cost?

Get a Free Estimate for Your Custom Lending Software

Please answer a few simple questions about your needs to help our experts calculate your tailored quote quicker.

Thank you for your request!

We will analyze your case and get back to you within a business day to share a ballpark estimate.

In the meantime, would you like to learn more about ScienceSoft?

- Project success no matter what: learn how we make good on our mission.

- 19 years in financial IT services: check what we do.

- 4,000 successful projects: explore our portfolio.

- 1,300+ incredible clients: read what they say.

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. We provide full-cycle application development services to help companies create reliable and secure lending apps. In our projects, we employ robust quality management and data security management systems backed up by ISO 9001 and ISO 27001 certifications.