Payment Automation

A Complete Guide

ScienceSoft applies 19 years of experience in payment software development to help businesses establish effective payment automation.

Payment Automation in a Nutshell

Payment automation helps eliminate manual tasks across all payment-related processes, from document processing and approval to payment execution and reconciliation. Automated payment software can also provide advanced payment analytics to ensure accurate planning of liquidity and working capital.

Payment types that can be automated:

- B2B payments (to suppliers, contractors, etc.)

- Tax payments

- Payroll-related payments

- Employee reimbursements

- Principal and interest payments on the existing liabilities

- Intercompany payments for multi-entity enterprises.

|

|

|

|

|

Key integrations: ERP, accounting software, vendor portal, procurement software, treasury software, HR system, etc. Implementation time: 6–11 months for a custom automated payment system. Development costs: $150,000–$400,000, depending on the solution’s complexity. Use our cost calculator to estimate the cost for your case. Annual ROI: 100–400%+. |

|

|

|

Main Payment Tasks to Automate

Payment document processing

Leverage AI, RPA, and image analysis technologies to automate up to 90% of tasks across the capture, extraction, and validation of data from payment documents.

Payment planning

Employ ML to analyze historical payment data and precisely forecast the due payment amounts. Rely on AI to get intelligent advice on the optimal payment time and method.

Payment execution

Establish the automated triaging and enforcement of payment transactions to accelerate the invoice-to-pay cycle and capitalize on vendor discounts.

Payment analytics

Get real-time calculation and 100% visibility of the required payment metrics and benefit from precise, data-driven planning of cash and liquidity.

Did you know?

- 70% of companies already have their invoice and payment tasks partially automated. Still, over 45% of firms rely on manual payment approval.

- ∼50% of duplicate payments result from manual data entry errors.

- 45% of enterprises still make over a half of their vendor payments via check – despite the fact that almost a third of all accounting fraud cases deal with check tampering and illicit payments.

- 25% of businesses miss vendor discounts due to delayed payments.

- Over 40% of businesses are seeking to increase the degree of payables automation to cut operational expenses and reduce fraud.

Ways to Establish Payment Automation

Payment workflows can be automated via three different approaches, each having its advantages and limitations. In ScienceSoft’s projects, we analyze the feasibility of the three for the client’s needs and help define the best-fitting option.

|

|

Ready-made payment automation tool |

Platform-based payment software |

Custom payment automation system ScienceSoft recommends |

|---|---|---|---|

|

Essence

|

Implementing market-available accounts payable software, which typically enables automated payment enforcement and provides payment status tracking dashboards. |

Building an automated payment solution of moderate complexity based on a low-code platform, e.g., Microsoft Power Apps. |

Building custom payment software to get all necessary automation capabilities and digitally transform your unique A/P workflows. |

|

Pros

|

|

|

|

|

Cons

|

|

|

|

Key Features of Payment Automation Software

ScienceSoft creates automated payment systems with functionality bound to each customer’s unique needs. Below, we share a comprehensive list of solution features commonly requested by our clients:

Although there are niche solutions that can handle particular payment automation tasks (e.g., automated invoice processing software), we usually recommend going for comprehensive payment automation system’s functionality. As long as you strive to get end-to-end payment automation, you need to make sure that manual efforts are eliminated across all payment-related processes, otherwise, the payment flow will still be slow and require human involvement. It means that if you don’t have dedicated solutions to automate payment document processing, we design your payment automation software to bridge this gap.

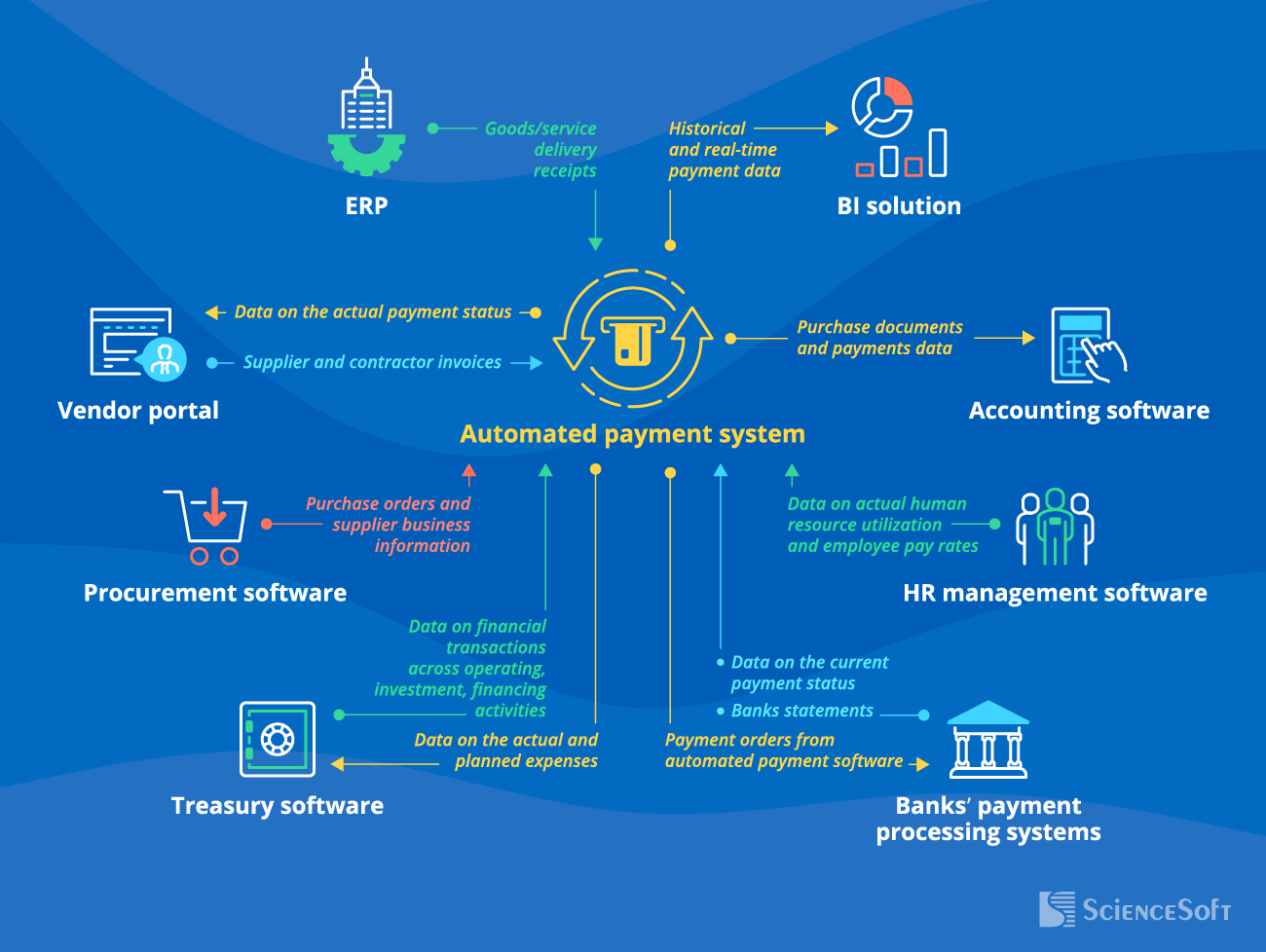

Essential Integrations for an Automated Payment System

Connecting payment software with relevant internal and third-party systems helps create a cohesive automation environment that needs minimal human involvement and improves payment process efficiency. ScienceSoft recommends establishing the following key integrations:

- For faster processing of supplier and contractor invoices.

- To keep suppliers and contractors up to date on the payment status.

For accurate recording of invoice data and payment information in the general ledger and relevant subledgers (an accounts payable ledger, a payroll ledger, a tax ledger).

- For automated invoice reconciliation against purchase orders.

- For automated input of supplier business information, including banking details, when generating payment orders.

For automated purchase invoice matching against goods/service delivery receipts.

For payroll automation.

For comprehensive payment analysis and reporting.

- For the automated calculation of taxes, principal and interest payments on the existing liabilities.

- For accurate planning of liquidity and working capital.

Banks’ payment processing systems

- For quicker payment processing.

- For real-time tracking of payment progress.

- For faster reconciliation of payments across multiple domestic and international bank accounts.

How to Ensure High ROI for Payment Process Automation

The ROI for an automated payment system can vary significantly (from 100% to 400%+), depending on the solution’s complexity and a company’s size and specifics. Below, ScienceSoft’s consultants share the main factors that help drive max payback:

End-to-end automation

To eliminate low-value manual tasks: payment document processing, payment approval, tax calculation, payment order generation, etc.

AI-based prescriptive analytics

To get intelligent recommendations, for example, on the optimal payment priority queue or payment methods for particular transactions to maximize cost savings.

Easy-to-use APIs

To integrate payment automation software with the required corporate and external systems and ensure real-time data sync.

Mobile access

To enable payment tracking and approval on the go.

ML-powered forecasting of payment amounts

To accurately plan cash and liquidity.

Robust security

To reduce the risk of illicit payments, malicious attacks, and sensitive data disclosure.

ScienceSoft’s Featured Success Stories

26 results for:

Custom Billing Platform for Secure, Scalable and Auditable Ecommerce Payments

A scalable custom platform automates cross-border billing and payment processing for a leading European marketplace. The solution enables quick, easy, and safe billing workflows and offers a lower TCO compared to third-party tools.

AI-Based Software Product for Fully Automated Invoice Processing

The solution automates invoice data capture, validation, and recordkeeping and submits valid invoices for payment, ensuring faster and more accurate invoice processing. The software offers intuitive user experiences and performs stably under heavy load.

Payroll System Redesign for a Home Healthcare SaaS in 4 Weeks

In just 4 weeks, ScienceSoft audited the payroll system of a home healthcare SaaS and designed a new feature set to enhance its capabilities and accuracy. We also analyzed the feasibility of implementing payroll system improvements and created a detailed project plan.

How Much Does Payment Automation Costs?

The costs and timelines of implementing custom payment automation software vary greatly depending on:

- The number and complexity of a solution’s functional modules, including AI-powered features.

- The number and complexity of integrations.

- The data volume that needs to be migrated from spreadsheets and legacy payment software.

- Availability, scalability, performance, and security requirements.

- The sourcing model (full outsourcing, team augmentation, or all in-house).

From ScienceSoft’s experience, custom payment automation software of average complexity may cost around $150,000–$300,000.

The cost to build a complex automated payment system for a large enterprise starts from $400,000.

Want to know the cost of your payment solution?

When to Opt for Custom Payment Automation Software

ScienceSoft recommends building a custom automated payment system in the following cases:

|

|

|

-

- You want smooth and cost-effective integration of the automated payment processing system and your business-critical software (ERP, a vendor portal, procurement software, HRMS, etc.).

- You need a solution that is compliant with region-specific regulations (e.g., to keep up with ZATCA’s e-invoicing requirements in Saudi Arabia).

- You need highly secure software providing advanced data protection capabilities (e.g., intelligent fraud detection, biometric authentication).

- You need a flexible automated system that is easy to evolve with new features as your business grows or new legal compliance requirements arise.

- You’re building a blockchain payment system and want to implement smart-contract-based payment automation.

Benefits of Payment Automation

With custom automated payment software, midsize and large businesses can reach 100–400%+ annual ROI, which is driven by:

Faster workflows

Vendor payment automation helps speed up the entire flow – from invoice intake to payment approval and sending, which enables up to 12x faster invoice-to-pay cycle.

Higher productivity

Automated payment processing drives 40–400% growth in the accounts payable team’s productivity due to eliminated low-value routine.

Improved accuracy

Robust payment automation software brings a 97% increase in payment accuracy due to minimized human involvement.

Optimized spend

AI-powered payment solutions help large enterprises unlock 1–3% cost savings thanks to intelligent suggestions on the optimal payment dates and methods.

Better supplier relationships

Timely payments and a decrease in DSO result in higher vendor satisfaction and offer an opportunity to win more favorable prices.

Minimized fraud risks

By automating payments, the company can safeguard its funds from malicious accountants’ activities and quickly spot fraud attempts.

Automate Payments with ScienceSoft

In corporate financial software development since 2007, ScienceSoft helps companies in 30+ industries build reliable automated payment solutions. Our top priority is driving development projects to their goals no matter what.

Payment automation consulting

- Analysis of payment processing automation needs.

- Assessment of the existing payment processes, tools, and their integration points.

- Suggesting optimal features, architecture, and tech stack for a payment automation system.

- Preparing a plan of integrations with the required internal and third-party systems.

- Consulting on security and compliance.

- Implementation cost & time estimates, expected ROI calculation.

Implementation of payment automation

- Payment automation needs analysis.

- Automated payment software conceptualization and architecture design.

- Custom payment automation software development or modernization of your existing payment solution.

- Integrating the solution with the required internal and third-party systems.

- Quality assurance.

- User training.

- Continuous support and evolution (if required).

Our Clients Say

We cooperated with ScienceSoft on the evolution of our Azure-based product for accounts payable management. ScienceSoft was to cover end-to-end development of an intelligent paperless invoice processing module for the product. ScienceSoft’s developers selected and implemented techs that ensured the system’s availability and fault-tolerance in the future. We were particularly pleased with neat alignment of the developed module with our requirements.

The new software module performs stably even under heavy load, which helps provide high quality user experience for our clients. ScienceSoft proved to be a reliable tech partner, and we can recommend other businesses to consider ScienceSoft as a software development vendor.

Wadih Pazos, Chief Operating Officer, Paramount WorkPlace

About ScienceSoft

ScienceSoft is a global IT consulting and software development company headquartered in McKinney, Texas. Since 2007, we help businesses design and implement effective payment automation software. Being ISO 9001- and ISO 27001-certified, we apply a mature quality management system and guarantee that cooperation with us does not pose any risks to our clients’ data security. Explore ScienceSoft’s financial software development offering to learn more about our approach.